A war, a volatile oil market, record fuel prices, a cost-of-living crisis, a new prime minister, tax cuts and U-turns. 2022 has been anything but boring and we still have 3 months to go. More than ever, businesses are feeling the pinch and are keen to reduce costs so what does all this volatility mean for fuel prices going forward?

Oil prices and Exchange rates

As a large fuel purchaser, we track oil prices and the pound to dollar exchange rate daily. The cost of diesel generally tends to reflect the oil price trend with similar increases and decreases in price. However, as oil is bought and sold in US Dollars, we also need to consider the exchange rate from Pound to Dollar to understand the true cost to British businesses.

Oil price impacts

As oil is a global commodity the impacts tend to be from big events. The two key ones in the last two years have been the huge fluctuations in demand caused by changing Covid restrictions and the unprovoked war in Ukraine by Russia which led to huge price increases based on fears of supply disruption and sanctions against Russian fuels.

More recently there have been moves by OPEC, (Organization of the Petroleum Exporting Countries) to seek to cut production of oil in order to maintain a price of $100 (the price around July 2022), which is 30-40% higher than the average seen prior to Covid. At the time of writing oil was just under $90 per barrel and at Right Fuel Card we’ll be much happier if the price remains well below the $100 per barrel mark as this will mean more vehicles on the road – better for business and, honestly, better for us.

Oil price 2018-2022 https://markets.businessinsider.com/commodities/oil-price

Exchange rates

As mentioned, the exchange rate from Pound to US Dollar has a huge impact on the final price British businesses pay for fuel. Prior to May 2022, the rate had largely fluctuated between 1.25:1 and 1.45:1. The rate started dropping below 1.25 in May after the Bank of England released projected inflation of 10%. However, more recently, the “mini-budget” put forward by Kwasi Kwartang in September 2022 caused a drop to just 1.05:1. This drop effectively makes purchasing fuel more expensive.

Thankfully, intervention by the Bank of England plus a reversal on part of the proposed budget has given markets more confidence, lifting the rate to 1.13 at the time of writing.

GBP:USD Exchange rate 2017-2022 British Pound to US Dollar Exchange Rate Chart | Xe

Europe is also feeling the pinch

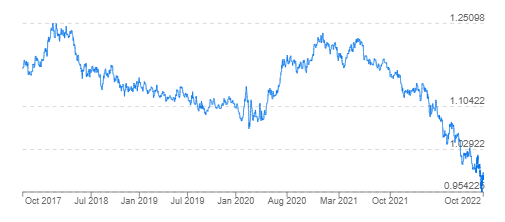

It’s worth noting that Britain’s high fuel price and cost of living crisis is not unique. The rest of Europe is also experiencing issues to varying degrees. Like the Pound, the Euro has also seen a substantial drop against the dollar falling from 1.13:1 to just 0.96:1 in September, driving up fuel costs across all European countries.

EUR:USD Exchange rate 2017-2022 Euro to US Dollar Exchange Rate Chart | Xe

RFC prediction for October

We expect fuel prices to remain relatively flat across October overall but with large fluctuations from week to week. The pound to dollar exchange rate looks to be continuing to improve following the intervention by the Bank of England and the partial reversal of the mini-budget. Significant changes in the Ukraine war, such as a ceasefire, would impact the price of oil but we do not expect this to happen any time soon. We will be keeping an eye on the OPEC supply rumours but again, we’re not expecting there to be drastic changes impacting the price during October.

Of course, this is just our opinion so for once, we may not be right!

| Jen GreenJen has extensive experience across a range of regulated industries. Her research on the monthly market movements for oil and how they will impact prices at the pump has been featured in numerous publications, including the Transport Operator and Fuel Oil News. |